【2018.08.28更新】期待已久的大通银行“sapphire banking”今日发布:

然而,并没有像自家顶着“sapphire”名头的CSP/CSR一样吸引人,甚至有些索然无味,更像是把之前的Chase Premier Platinum Checking给改了改名字,针对高端客户套用了sapphire的名气。虽然免去了部分银行费用,但是要达到75K才能申请,以下是这款储蓄产品的基本情况:

· 目前没有开户奖励。

· 月费 $25,账户内最低月平均余额达到$75K可免月费。

· Chase 是全国性大银行,网点众多。

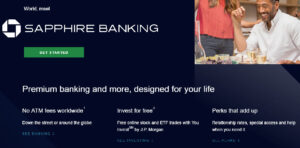

· No ATM fees worldwide: There is no Chase fee at non-Chase ATMs, Chase will refund ATM fees charged by the ATM owner, and no Foreign Exchange Rate Adjustment Fee.

· Invest for free: Free online stock and ETF trades with You Invest by J.P. Morgan.

· Earns interest.(低到可以忽略不计)

· Fee waived for checks (Personal design checks).

· Fee waived for counter checks, money orders and cashier’s checks.

· Monthly service fee waived on any linked personal Chase savings account(s).

· Additional linked Chase Checking accounts with no monthly service fee (9 Chase SapphireSM Checking accounts).

· Fee waived for stop payments.

· Fee waived for incoming wire transfers.

· Fee waived for insufficient funds or returned items if you have 4 or fewer occurrences in previous 12 months.

· Chase Checking 使用不当有可能会被全家桶,请绝对避免使用 Chase Checking 做以下几件事:存大额现金、规律性存现金、存 Money Order、境外大额汇款。正常地把工资 Direct Deposit 进去、存支票、美国的银行之间互相转账都没关系。

如果要总结一下的话,不要申请就对了,除非是蓝宝石系列产品铁粉。

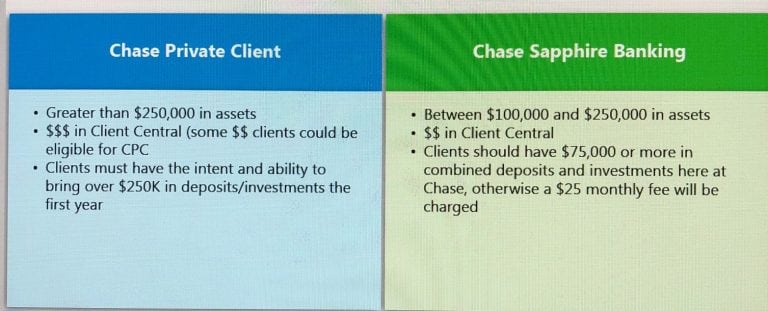

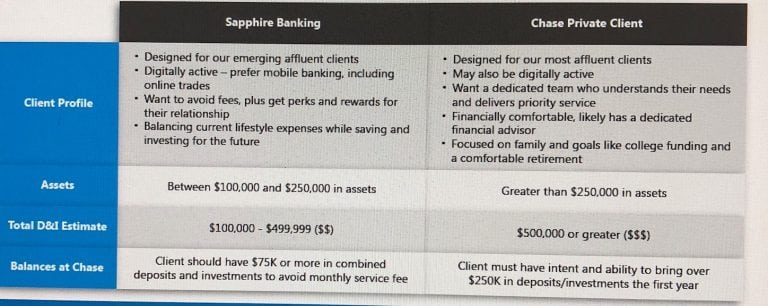

我们都知道,大通银行一直存续的一项非常尊贵的业务就是Chase Private Client大通银行的私人银行业务,只针对资产数达$250,000以上的客户开放。

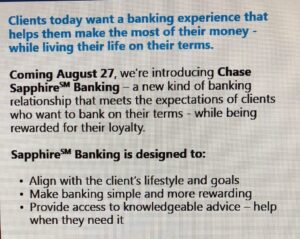

而近日,不断有传闻称,大通正计划上线一款新的私人银行业务,来对$100,000-$250,000的资产区间进行填充,名称为“Sapphire Banking”蓝宝石银行,存款和投资都将计入门槛

不过,很有意思的一点是,对$250,000起的Private Client来说,并不需要他们真的存入大通银行$250,000,而是有意图及能力存入$250,000的用户,也就是说,即使这笔钱存放在别处,也是有可能受到大通银行Private Client待遇的;不同的是,Sapphire Banking则需要用户真金白银的在大通银行处有$100,000的资产。

关于这个Sapphire Banking,其实可以理解为借助Sapphire蓝宝石(CSP/CSR)的名声、以Chase现有的储蓄产品Chase Premier Platinum Checking (PDF)重塑了一个完整的独立的产品系列,用以区别于$100,000以下资产的普通储蓄产品,旨在为顾客打造尊贵体验。

拔草酱

拔草酱