在网上申请Checking、Savings账户和部分信用卡的时候,网页上会需要你确认你是 U.S. Person:“Under penalties of perjury, I certify that: I am a U.S. citizen or other U.S. person.”。

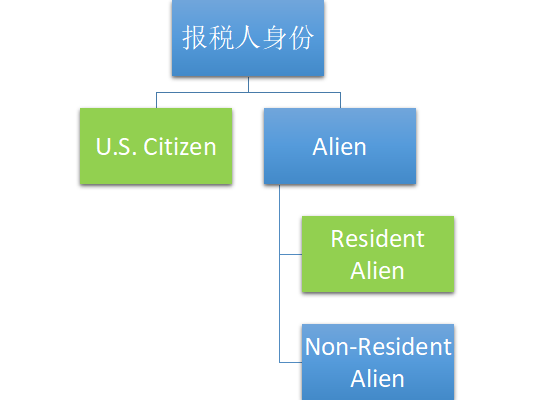

什么是 U.S. Person?什么是Non-Resident Alien?什么是Resident Alien?跟Permanent Resident 有什么区别?

这些词语在报税的意义下,都是有严格定义的,我们将在此文中按照 IRS (Internal Revenue Service) 给的官方说明向大家尽量解释清楚这些身份之间的区别与联系。

注意本文谈论的是信用卡/银行账户相关的定义,因此讨论的其实是W-9/W-8表格中的定义,即联邦税。各州在收取地方税时会存在身份区分的差异,请咨询当地税务。

首先解释一下各个名词的意思:

1、U.S. citizen,即是美国公民,这个不需要解释了吧…需要注意的是,请不要谎报身份,否则后果轻则影响绿卡申请,重则监狱伺候。

2、Alien,只要非美国公民,就是Alien,Alien分为两种, Resident Alien(RA)和 Non-Resident Alien(NRA)。

·若持有绿卡,或满足以下条件,身份既是RA:

1.31 days during the current year, and

2.183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

All the days you were present in the current year, and

1/3 of the days you were present in the first year before the current year, and

1/6 of the days you were present in the second year before the current year.

而上述的判断依据还有重要的细则:

Definition of Exempt Individual

·Foreign Government Related Individual

·Employee of Foreign Government

·Employee of International Organization

·Usually on A or G visa;

·Teacher, Professor, Trainee, Researcher on J or Q visa;

·Does NOT include students on J or Q visas;

·Does include any alien on a J or Q visa who is not a student (physicians, au pairs, summer camp workers,etc.);

·must wait 2 years before counting 183 days; however if the J or Q alien has been present in the U.S. during any part of 2 of the prior 6 calendar years in F, J, M, or Q status, then he is not an exempt individual for the current year, and he must count days in the current year toward the substantial presence test;

·Quality of being an Exempt Individual applies also to spouse and child on J-2 or Q-3 visa;

·Student on F, J, M or Q visa;

· must wait 5 calendar years before counting 183 days;

·the 5 calendar years need not be consecutive; and once a cumulative total of 5 calendar years is reached during the student’s lifetime after 1984 he may never be an exempt individual as a student ever again during his lifetime;

·Quality of being an Exempt Individual applies also to spouse and child on F-2, J-2, M-2, or Q-3 visa;

Professional athlete temporarily present in United States to compete in a CHARITABLE sports event.

其中有一条格外重要,F1/F2F身份的前5年一定是NRA,J1/J2身份的前2年一定是NRA

3.U.S. Person,包括U.S. Citizen和RA,不包括NRA。

为了方便理解这个关系,我们做了个图,其中绿色格为U.S. Person

拔草酱

拔草酱